Cryptocurrency-backed Assets

Building trustless cross-blockchain trading protocols is challenging. Centralized exchanges thus remain the preferred route to executing transfers across blockchains. However, these services require trust and therefore undermine the very nature of the blockchains on which they operate. To overcome this, several decentralized exchanges have recently emerged which offer support for commit-reveal atomic cross-chain swaps (ACCS).

Commit-reveal ACCS, most notably based on HTCLs, enable the trustless exchange of cryptocurrencies across blockchains. To this date, this is the only mechanism to have been deployed in production. However, commit-reveal ACCS face numerous challenges:

Long waiting times: Each commit-reveal ACCS requires multiple transactions to occur on all involved blockchains (commitments and revealing of secrets).

High costs: Publishing multiple transaction per swap results in high fees to maintain such a system.

Strict online requirements: Both parties must be online during the ACCS. Otherwise, the trade fails or, in the worst case, loss of funds is possible.

Out-of-band channels: Secure operation requires users to exchange additional data off-chain (revocation commitments).

Race conditions: Commit-reveal ACCS use time-locks to ensure security. Synchronizing time across blockchains, however, is challenging and opens up risks to race conditions.

Inefficiency: Finally, commit-reveal ACCS are one-time. That is, all of the above challenges are faced with each and every trade.

Commit-reveal ACCS have been around since 2012. The practical challenges explain their limited use in practice.

Cryptocurrency-back Assets (CbA)

The idea of CbAs is that an asset is locked on a backing blockchain and issued 1:1 on an issuing blockchain. CbA that minimize trust in a third-party are based on the XCLAIM protocol. The third parties in XCLAIM are called vaults and are required to lock collateral as an insurance against misbehaviour.

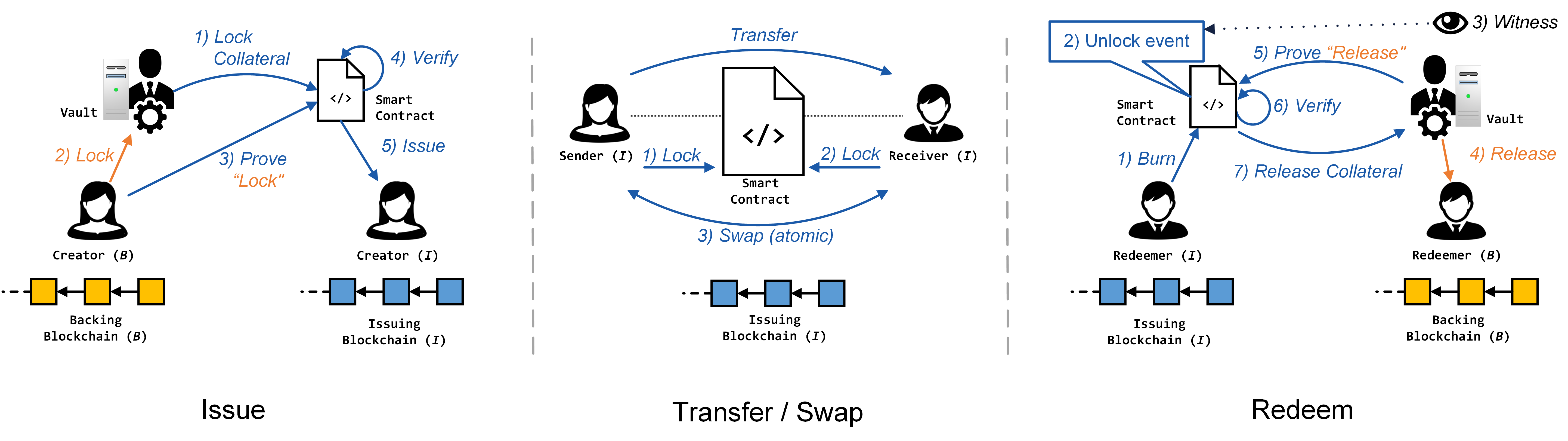

XCLAIM introduces three protocols to achieve decentralized, transparent, consistent, atomic, and censorship resistant cross-blockchain swaps:

Issue: Create Bitcoin-backed tokens, so-called interBTC on the BTC Parachain.

Transfer: Transfer interBTC to others within the Polkadot ecosystem.

Redeem: Burn Bitcoin-backed tokens on the BTC Parachain and receive 1:1 of the amount of Bitcoin in return.

The basic intuition of the protocol is as below:

Fig. 4 The issue, transfer/swap, and redeem protocols in XCLAIM.

Design Principles

XCLAIM guarantees that Bitcoin-backed tokens can be redeemed for the corresponding amount of Bitcoin, or the equivalent economic value in DOT. Thereby, XCLAIM overcomes the limitations of centralized approaches through three primary techniques:

Secure audit logs: Logs are constructed to record actions of all users both on Bitcoin and the BTC Parachain.

Transaction inclusion proofs: Chain relays are used to prove correct behavior on Bitcoin to the BTC Parachain.

Proof-or-Punishment: Instead of relying on timely fraud proofs (reactive), XCLAIM requires correct behavior to be proven proactively.

Over-collateralization: Non-trusted intermediaries, i.e. vaults, are bound by collateral, with mechanisms in place to mitigate exchange rate fluctuations.

Recommended Background Reading

XCLAIM: Trustless, Interoperable, Cryptocurrency-backed Assets. IEEE Security and Privacy (S&P). Zamyatin, A., Harz, D., Lind, J., Panayiotou, P., Gervais, A., & Knottenbelt, W. (2019).

Enabling Blockchain Innovations with Pegged Sidechains. Back, A., Corallo, M., Dashjr, L., Friedenbach, M., Maxwell, G., Miller, A., Poelstra A., Timon J., & Wuille, P. (2014)

SoK: Communication Across Distributed Ledgers. Cryptology ePrint Archiv, Report 2019/1128. Zamyatin A, Al-Bassam M, Zindros D, Kokoris-Kogias E, Moreno-Sanchez P, Kiayias A, Knottenbelt WJ. (2019)

Proof-of-Work Sidechains. Workshop on Trusted Smart Contracts, Financial Cryptography Kiayias, A., & Zindros, D. (2018)